How Do Executive Search Firms Find Candidates in 2026?

Dara Khosrowshahi didn’t apply to become the CEO of Uber.

Uber didn’t wait for resumes.

They ran a retained executive search and pulled him out of Expedia Group.

That’s executive search.

It’s not posting roles. It’s not filtering applicants.

It’s mapping entire markets. Ranking 100+ leaders per mandate. Running sourcing, outreach, and evaluation in parallel — across dozens of tabs.

And yet most systems still force consultants to work like it’s 2012: candidates here, jobs there, notes somewhere else.

So what does executive search really look like today?

In this guide, we unpack how executive search firms find candidates from building targeted leadership maps and leveraging deep industry networks to engaging passive talent and advancing searches with precision and discretion.

First, The Basics: What Is Executive Search?

Executive search is a specialized hiring approach focused on placing senior leaders: C-suite executives, VPs, Directors, and other high-impact roles that directly shape a company’s strategy and performance.

Unlike traditional recruitment, executive search is:

- Proactive, not reactive – candidates are identified and approached directly, rather than sourced from job applications.

- Research-led – firms map target markets, competitors, and leadership teams to build a precise shortlist.

- Relationship-driven – most candidates are passive, so outreach relies on trust, positioning, and long-term networks.

- High-touch and consultative – search partners work closely with clients to define success beyond skills, including leadership style and cultural fit.

How Do Executive Search Firms Find Candidates?

Executive search doesn’t run on job ads. It runs on research, relationships, and repeatable workflows.

Here’s what that actually looks like inside most executive search firms.

1. Market mapping: building the leadership universe

Recruiters map target companies, reverse-engineer org charts, and identify executives in comparable roles across competitors and adjacent markets.

This isn’t surface-level LinkedIn browsing; it involves:

- Tracking reporting structures

- Identifying the previous incumbent in the role

- Understanding mobility patterns between firms

- Segmenting candidates by industry exposure, and scale experience

This market map becomes the backbone of the entire search.

2. ATS rediscovery and silver-medalist mining

Before outreach begins, most firms search internally.

They query their ATS or CRM for:

- previous finalists

- past exploratory conversations

- inbound executive resumes

- referrals from prior mandates

Keyword searches still play a role, but senior consultants often rely on memory to resurface “near-miss” candidates from earlier searches.

The real value is context: past conversations, objections, timing signals, and relationship history.

Some teams now use tools like AIRA Matchmaker to help surface these signals and explain why a candidate fits — while keeping consultants fully in control of the decision.

Without living context, ATS records are just static profiles.

3. LinkedIn Recruiter + activity signals

LinkedIn Recruiter remains the primary external discovery layer in executive search. Recruiters filter by title, company, industry transitions, and geography, then use activity signals to prioritize outreach.

What LinkedIn doesn’t capture is context — past conversations, intent, or relationship history.

In teams using Natural Language Search like AIRA Source, we observed a sharp drop in sourcing time: from an average of three days to roughly 24 hours.

The improvement came from reducing tool-switching and shortening the gap between finding candidates and starting conversations.

4. Passive candidate sequencing (multi-channel outreach)

Executive search firms run structured sequences across multiple channels:

- personalized email or InMail

- follow-ups spaced over days or weeks

- phone or SMS touchpoints when appropriate

- warm introductions via mutual contacts

- confidential discovery calls

In practice, this has become multi-channel relationship management at scale: coordinating email, calls, messaging apps, and social touchpoints while maintaining continuity of context across every interaction.

That continuity matters. Without it, sequences fragment, personalization drops, and consultants end up repeating conversations instead of building on them.

5. Multi-layer evaluation and calibration

Executive search used to rely heavily on partner instinct.

Today, leading firms layer judgment with data. Some use formal scoring models, for example, ZRG Partners applies Z-scores, while Heidrick & Struggles runs candidates through proprietary leadership frameworks.

In practice, interested candidates move through a structured evaluation:

- exploratory interviews

- leadership and competency assessments

- reference checks

- sometimes psychometric profiling

With tools like AIRA Notetaker, call context is recorded automatically, reducing reliance on manual notes and memory and keeping candidate profiles current.

Executive search prioritizes precision over volume, typically presenting 3–7 highly aligned candidates per mandate.

6. Execution coordination and placement

From there, firms manage:

- interview logistics across stakeholders

- feedback loops

- compensation alignment

- lengthy notice periods

What looks linear on paper is actually dozens of parallel conversations, documents, reminders, and follow-ups happening simultaneously.

The technical reality

Executive search today runs on:

- external discovery (market maps and LinkedIn)

- internal data (ATS and historical searches)

- manual research

- human judgment

- relationship memory

It works, but it’s fragmented.

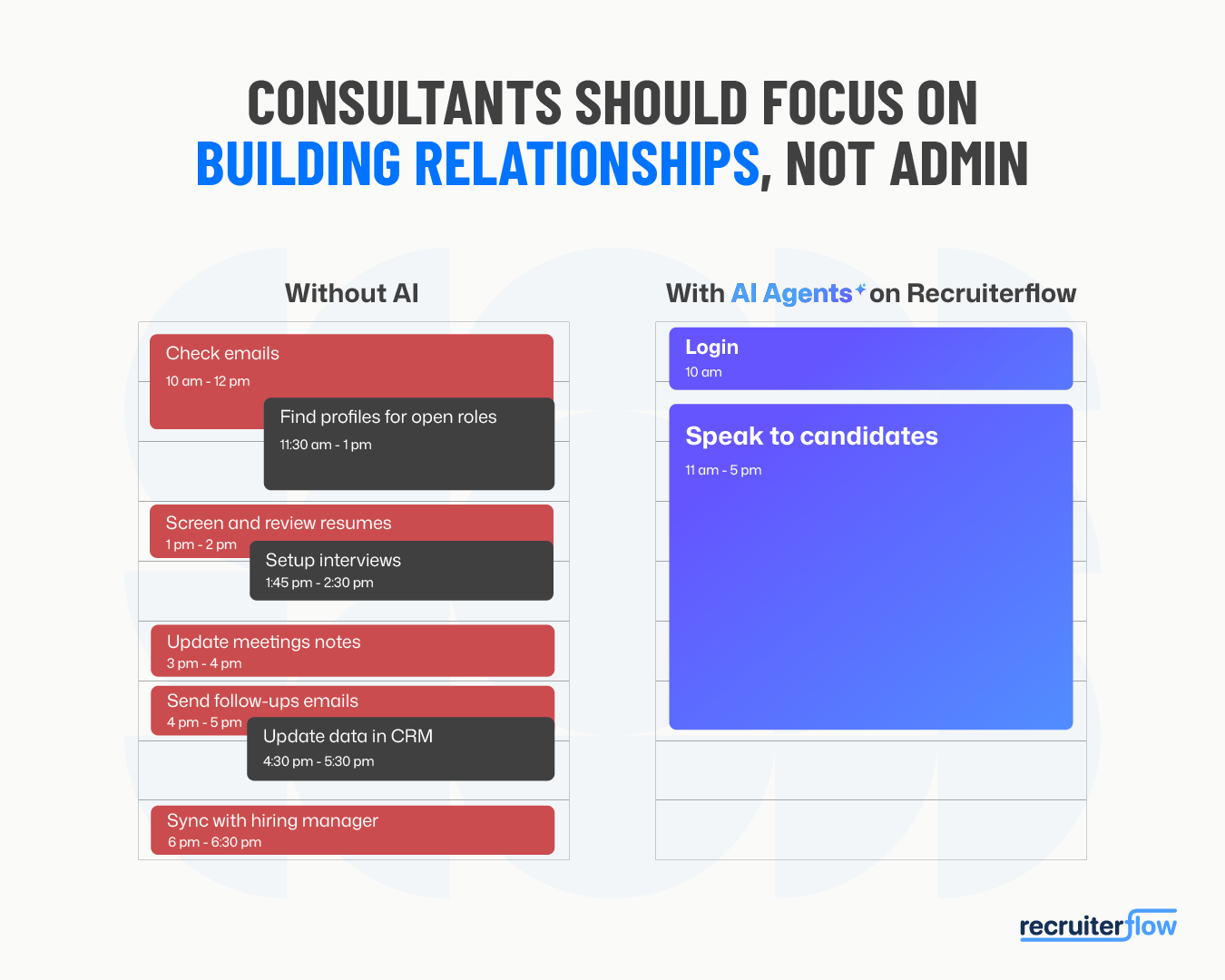

A better alternative? Treating AI Agents as execution partners, like Recruiterflow does — continuously capturing context from calls, updating CRM records, monitoring job changes, and supporting sourcing and outreach in the background.

Put simply, it’s an AI Twin for every consultant: running in parallel, keeping data fresh, surfacing intent, and removing the admin that slows searches down.

See how Recruiterflow turns context into placements – Get a demo.

Frequently Asked Questions

What percentage of executive candidates are passive?

Roughly 70–80% of executive-level candidates are passive. Most senior leaders are not actively applying for roles; they’re open to the right opportunity at the right time. This is why executive search relies on direct outreach, timing, and context rather than inbound applications.

How long does an executive search take?

A typical executive search takes 8 to 16 weeks, depending on role nuances, market conditions, and decision velocity. Delays usually come from alignment issues, slow outreach cycles, or fragmented execution — not a lack of available candidates.

Do executive search firms use AI?

Yes, but mostly at the execution layer.

AI is increasingly used to capture call context, update CRM data, monitor job changes, support sourcing, and streamline outreach. It does not replace consultant judgment or relationship-building. Instead, it removes administrative friction so consultants can focus on conversations and placements.

Recruitment

Ayusmita