Guide to Market Mapping in Recruitment in 2026

The recruitment market today is an ever-evolving beast. The strategies that worked in 2024 are obsolete and the new playbook is here. Here are a few stats that to paint a picture:

- About 70% of the global workforce is passive. They are not applying to jobs, but would move for the right opportunity.

- 75% of employers struggle to find the right talent.

- The best candidates are off the market within 10 days.

In 2026, recruiters and agencies have to map the market before they need new talent. That’s what this guide will help with.

In this guide, we will discuss market mapping in recruitment: what it is, how to do it, the types of market mapping, tools, KPIs, and how to operationalize it with an AI-first tool like Recruiterflow.

What is Market Mapping in Recruitment?

Market mapping in recruitment is a structured process focused on researching and organising the talent, companies, and roles in a given niche. The intent is to know exactly the talent that is out there, where they are located (as employees), and how to approach them.

The process is proactive. You’re not waiting around until a job order comes. Talent mapping in recruitment covers companies, organisation structures, individuals, rather than a loose list of names.

You’ll see talent market mapping most frequently used in executive searches, niche roles and especially competitive roles.

Market mapping vs Talent Mapping vs Recruitment Process Mapping

| Term | What It Actually Means | What It Looks At | Why You Do It | Best Used When |

| Market Mapping | Mapping the external hiring ecosystem | Companies in a niche, their org charts, who leads each function, compensation bands, hiring trends, talent density | To understand the structure and dynamics of the talent market before hiring | When entering a new market, pitching retained/executive search, or educating clients the on market |

| Talent Mapping | Mapping people who could be relevant now or later | Specific candidates, their backgrounds, skills, seniority, compensation expectations, career motivations, readiness to move | To build a pipeline of future-ready candidates rather than waiting for applicants | When hiring recurring or hard-to-fill roles, building leadership benches, or reducing time-to-hire |

| Recruitment Process Mapping | Mapping the internal hiring workflow | Stages of pipeline, owners of each stage, handoffs, bottlenecks, candidate experience, speed | To create a predictable, consistent, high-performance hiring process | When time-to-fill is high, candidate experience is inconsistent, or the hiring team is being scaled |

Why Market Mapping Matters In 2026 & Beyond

The demand for talent far exceeds the supply, especially for technical and specialist roles. Market mapping is how high-performing recruiters stay ahead of the competition.

Macro trends shaping recruiting today (that necessitate talent mapping tools):

- 75% of employers report difficulty filling roles. Source

- Global average time-to-fill is 54 days. Average time-to-hire is 44 days.

- The best candidates leave the market in ~10 days. Source

Market mapping closes these gaps by converting recruitment from reactive to strategic. When conducted well, it can deliver:

- Pre-qualified talent pools ready to activate. You get a curated, segmented, and pre-researched pool.

- Credible, data-driven market intelligence: You get insights on:

- Salary benchmarks

- Org structures

- Competitor landscapes

- Diversity representation

- Hiring velocity and talent movement

- Geographic and mobility patterns

- The ability to advise clients: You no longer just fill a role. Instead, you can solve a hiring problem backed by real data that lets you advise them better. For instance, “This role takes 60+ days on average to fill in your industry.” or “Top candidates leave the market in 10 days.” You go from vendor to trusted advisor.

Types of Market Mapping in Recruitment

There is no one single taxonomy for market mapping. Every firm does it a little differently. However, real-world market mapping tends to fall into these four categories:

Note: Most recruiters blend two or three of these, especially at leadership, technical, and strategy levels.

| Term | What it is | Benefits |

| Talent Market Mapping (Role or Function-Based) | Maps people based on a specific role, function, or skill set : identifying where talent currently works, their reporting lines, career paths, compensation bands, and remote/hybrid distribution. | • Builds shortlists for complex, senior, or specialist searches • Helps understand role maturity and career progression • Benchmarks compensation and titles across companies |

| Competitor/ Company Landscape Mapping | Maps companies : their structures, leaders, hiring origins and destinations, EVP, and competitiveness. Shows where the right talent sits. | • Helps win retained/executive search projects • Supports clients entering new markets/geographies • Provides compensation & competitiveness insights • Moves recruiters from CV suppliers to strategic advisors |

| Perceptual & Positional Market Mapping | Visualizes how employers or talent compare : either through perceptions (e.g., corporate vs startup) or objective metrics (e.g., team size vs revenue). | • Reframes unrealistic client expectations • Helps build compensation or EVP improvement business cases • Shows where a client’s brand sits relative to competitors |

| Pipeline-Focused Market Mapping | Maps target customers for recruiting agencies : Ideal Customer Profiles, high-value companies, hiring patterns, growth signals, decision-makers, etc. | • Scales agency revenue predictably • Supports shift from contingency to retained • Prioritizes high-value/high-growth clients • Forecasts revenue based on hiring patterns |

Recruiterflow’s AI candidate matching helps run such market mapping exercises. It rediscovers high-quality candidates already in your existing system, even if they’ve been unresponsive.

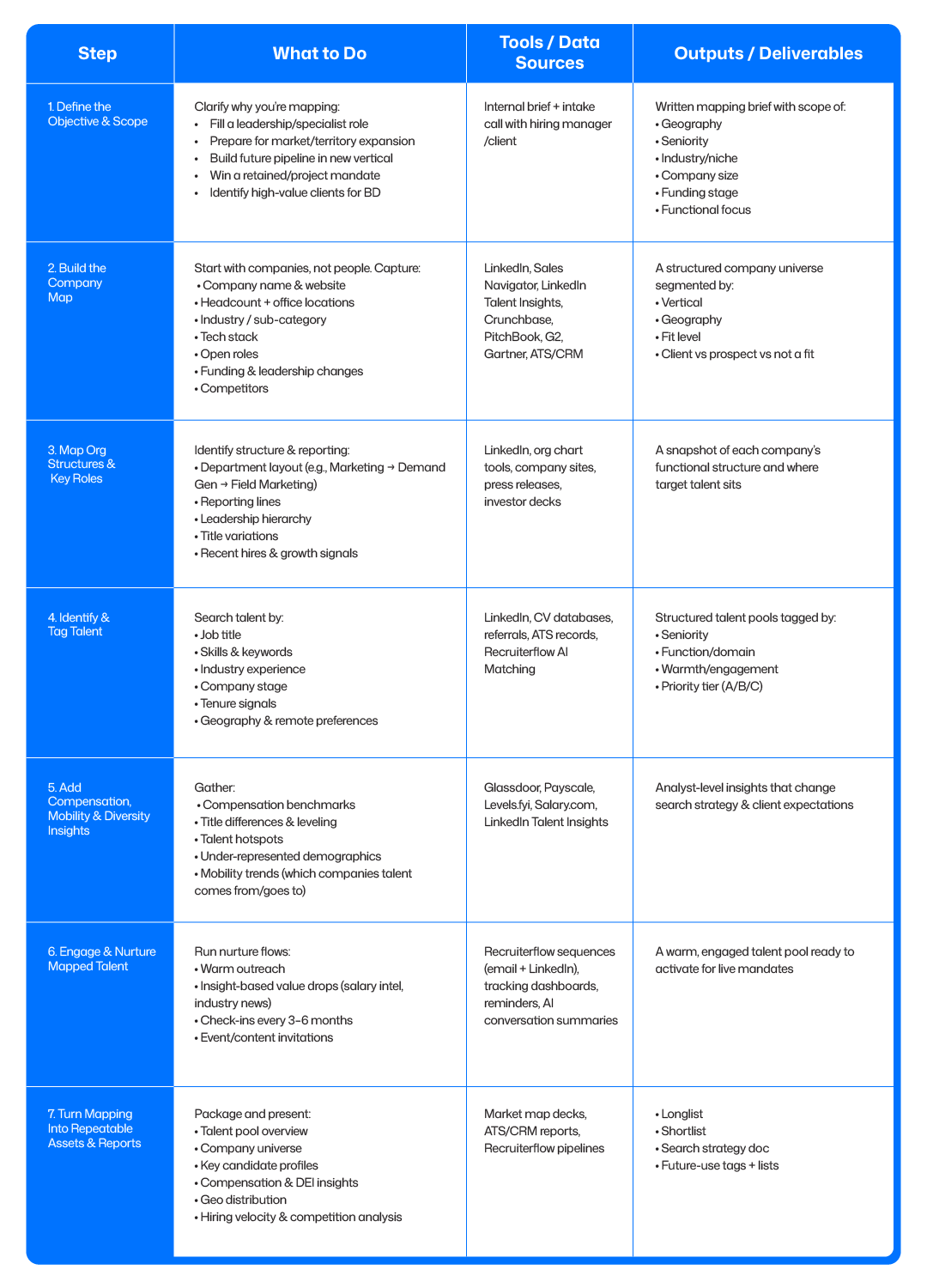

How to Do Market Mapping in Recruitment (Step-by-Step)

Most recruiters only map their market accidentally, with data scattered in half-finished spreadsheets, ad-hoc bookmarks, saved LinkedIn searches, and messages in their inbox.

But when you start market mapping more systematically, things change. Searches start faster. Clients trust you more. Candidates stay warmer. And your team doesn’t have to reinvent the wheel each time a new job order comes in.

Step 1: Define the Objective and Scope

Start with clarity. Market mapping without a clear purpose will send you down an endless and expensive research rabbit hole. Ask yourself: What problem are you trying to solve?

- Fill a specific leadership or specialist role?

- Prepare for a client’s upcoming expansion (new geography, new product)?

- Build a future pipeline in a new vertical?

- Win a retained or project mandate?

- Identify high-value clients for BD?

- Support a client’s workforce planning or re-org?

Next, define realistic constraints:

- Geography: Global EMEA UK only Remote-friendly talent

- Seniority: IC Manager Director VP C-Suite

- Industry/Niche: SaaS MedTech FinTech Climate BioPharma Manufacturing

- Company size: 50–200 200–1,000 Enterprise only

- Funding stage (if relevant): Seed Series C Public

- Functional scope: RevOps Data Engineering Brand Marketing Clinical Affairs

An example of a good market mapping brief would be:

“Map Director-level and above Data roles across B2B SaaS companies with 200–1,000 employees in the UK & DACH region, focusing on product-led growth companies backed by Tier 1 VCs.”

Step 2: Build the Company Map

Start with companies, not people. Don’t focus on producing a “candidate list,”. You need a “market map.”

Use the right tools to proceed:

- LinkedIn: Company search, Sales Navigator account lists.

- LinkedIn Talent Insights: Talent pools, workforce movement.

- Crunchbase: Funding, leadership, size, growth.

- PitchBook: Deep private company intel.

- G2 / Gartner: Industry leaders, product categories.

- Your own ATS/CRM: Past clients, submission history, warm companies.

Collect the following data points on each company:

- Name, website, and HQ.

- Employee count (overall + regional).

- Office locations.

- Industry and subcategories.

- Tech stack (if relevant).

- Open roles

- Signals (funding rounds, acquisitions, leadership changes).

- Competitors & adjacent companies.

Recruiterflow assists users with building this talent ecosystem by creating CRM assets focusing on:

- Companies tagged by region, ICP, vertical.

- Company tiers (A/B/C) based on client fit.

- Differentiation between “client,” “prospect,” and “not a fit”.

Step 3: Map Org Structures and Key Roles

Now that you have your list of companies, dissect them to figure out how they really function. Here’s where you look:

- LinkedIn: Search by department, title patterns, leadership hierarchy.

- Org chart tools.

- Leadership pages on company websites.

- Press releases + news (hiring announcements reveal structure).

- Annual reports or investor decks (especially for public companies).

- Industry reports (for roles like Product, Clinical, or Engineering).

Here’s what you capture:

- Department structure

- e.g., Marketing Demand Gen Field Marketing

- Reporting lines

- Who reports to whom

- Who owns what

- Title variations

- Director of Product vs Head of Product vs Product Lead

- Growth signals

- Who was hired recently

- Which roles keep opening up

- Team size by level

- ICs vs managers vs VP-level

This reveals where talent sits and who matters for your purpose.

Step 4: Identify and Tag Talent

Time to build the actual map of candidates.

Start by searching for:

- Job titles

- Skills

- Keywords unique to the field

- Industry experience

- Company stage

- Tenure

- Geography (local, remote, hybrid)

Log this data into your ATS/CRM properly. Don’t just “add to the database.” or label a “quick tag.”

Create the following:

- Lists/pools for each mapping project

- Tags for:

- Role type

- Seniority

- Domain (SaaS, oncology, fintech, robotics)

- Warmth (how approachable they are)

- Priority

Recruiterflow’s AIRA Matchmaker simplifies the process. It reads the job description, parses your notes, and compares historical interaction patterns to find the strongest candidates already in your database.

After that, the AI agents enrich profiles, suggest updates, keep the CRM clean, flag engagement triggers, and summarize emails and call history.

Step 5: Layer in Compensation, Mobility & Diversity Insights

Use hard data to calculate compensation bands. Include insights from Glassdoor, Playscale, Salary.com, and LinkedIn Talent Insights.

The insights you need to include:

- Compensation bands across levels.

- Title variations (“Lead” meaning “Senior IC”, depending on the company)

- Talent hotspots (Dubai for ML Engineers, Dublin for Pharma Regulatory, etc.)

- Hidden talent in remote-friendly emerging markets

- Diversity distribution across departments and levels

- Mobility patterns (where do top performers come from? where do they go?)

Step 6: Engage and Nurture Mapped Talent

At this point, you start building relationships early, with both candidates and potential clients. Create nurture flows for each talent segment, covering:

- Warm outreach (“We’re noticing emerging trends in your domain…”).

- Personalised insights (salary trends, industry shifts).

- Occasional check-ins.

- Invitations to client roundtables, events, or content.

- Articles or reports relevant to their career growt.h

The process becomes easier with Recruiterflow, as it provides multichannel sequences (email, LinkedIn, tasks), open/click tracking, AI summaries of past conversations, automated reminders, and triggers when someone changes jobs.

Bear in mind: mapping engagement revenue.

Step 7: Turn Mapping Into Repeatable Assets & Reports

Build the following deliverables that your clients can keep acting on.

For executive search and retained projects, create a polished market map deck including:

- Talent pool overview

- Target company universe

- Key candidate profiles

- Compensation insights

- Diversity snapshot

- Geographic map of talent distribution

- Hiring velocity & competition analysis

Store the following data Inside your ATS/CRM:

- A clean longlist

- A shortlist with clear stage definitions

- Notes + summaries for every conversation

- Tags that allow future re-use

Benefits of Market Mapping in Recruitment

Let’s look at the outcomes you get by implementing market mapping and talent mapping tools appropriately.

- Faster time-to-fill & time-to-submit: Closely mapped markets and pre-warmed pipelines help recruiters start searches with known candidates rather than strangers. You can shortlist and submit in days, not weeks.

- Better quality-of-hire and retention: Market mapping lets you target high-caliber candidates who are often passive, not on job boards. You get candidates with better fit, lower early attrition, and repeat business.

- Competitive intelligence and advisory power: You get data-backed views of competitor hiring velocity, salary & benefits benchmarks, talent density, diversity gaps, emerging job titles, and skill clusters. Recruiters go from telling clients, “We’ll send you CVs” to “Here’s how your EVP, comp, and role design compares to the market.”

- More predictable sales pipeline: Market mapping helps recruiters understand how their target accounts work, to a T. By segmenting them into potential value and fit, they can run focused business development instead of “Hail Mary” cold calls.

Recruiterflow’s ATS + CRM + sequences make this operationally simple. Just use tags and pipelines to manage prospects, connect outreach campaigns to mapped segments. The AI agents will keep notes and next steps up to date.

KPIs & Measuring the Success of Market Mapping in Recruitment

Track these concrete KPIs to monitor the impact of market mapping solutions.

- Time-to-fill: days from job approval to accepted offer.

- Time-to-shortlist / time-to-first-submit: days from job approval to sending your first qualified candidates.

Pro-Tip: We’ve found that a 20–30% reduction is a strong early signal that your mapping is working.

- number of mapped candidates per priority role type.

- number of mapped companies per ICP segment

- Coverage vs target (e.g., “mapped 80% of Series B–D startups in the UK that match ICP.”)

Pro-Tip: Recruiterflow lets you use saved searches, tags, and custom fields to track KPIs. You also get dashboards and reports for pipeline health across roles and clients.

For each mapped segment, track:

- Outreach Response rate

- Response Conversation/screening rate

- Conversation Shortlist/submission

- Shortlist Interview

- Interview Offer Placement

The above will flag which market mapping operations are converting, as well as where messaging or targeting needs work.

Don’t forget to track:

- 90-day and 12-month retention.

- Hiring manager satisfaction.

- Repeat roles from the same client/function.

Map your efforts to:

- % of revenue from retained / exclusive work.

- Average fee per placement in markets where you map vs where you don’t.

- Margin per recruiter (billings vs desk cost).

Market mapping is the foundation of competitive recruiting. In 2025, recruiters and talent teams with the biggest databases or the loudest outreach will be beaten by those who understand their markets better than anyone else.

To win in the increasingly competitive recruitment game, recruiters need to know:

- Where the talent is.

- How teams are structured.

- What compensation actually looks like.

- Who’s ready to move — and who isn’t yet.

- Which clients are worth pursuing — and which are time sinks.

Market mapping yields this data, which goes a long way to building trust, winning retained work, and turning recruiters into strategic partners.

And Recruiterflow can help you get there.

Instead of juggling spreadsheets, inboxes, job boards, and sticky notes, Recruiterflow unifies all pertinent data in a single UI. You also get:

- AI agents that update records, enrich profiles, and summarise conversations.

- AI matching that finds the right candidates in your database instantly.

- Sales + recruitment automation to nurture both clients and talent over time.

- ATS + CRM in a single platform, so market mapping becomes a revenue engine instead of a research exercise

Not convinced? How about a demo?

Let us show you how to convert data into placements, revenue, and long-term client loyalty.

Recruitment

Ayusmita