12 Best Payroll Software for Staffing Agencies in 2026

Managing payroll can be a complex and intricate process for staffing agencies. As they work with multiple clients and employ different types of workers; such as full-time and part-time employees, contractors, and freelancers.

But, staffing agencies can simplify payroll processing by using payroll software. These payroll software solutions automate manual payroll processes and ensure timely and accurate payroll management.

But, with so many options available in the market, it is apt to be confused about choosing the right one. To simplify, we have listed the 12 best payroll software for staffing agencies with their features, pricing, and user reviews.

What is payroll software?

Payroll software is designed to automate and streamline managing employee payrolls. It helps businesses to calculate employee salaries, taxes, and other deductions accurately and quickly. The software can also manage employee attendance, leave, and other benefits.

Payroll software usually comes with features like direct deposit capabilities, tax filing and compliance tools, and time tracking and scheduling. The software can also generate detailed reports and analytics on payroll data, making it easier for businesses to analyze payroll expenses.

Also Read: How Staffing Automation Can Revamp Your Staffing Business

Why should staffing agencies use payroll software

Efficient Payroll Processing

Calculating the salary for each employee/contractor can be time-consuming and presents a higher opportunity for manual errors. Utilizing payroll software, staffing agencies can automate this process. Thus, spending less time on back-office activities and focusing on what matters most, placing top talent promptly. Using “error detections,” agencies can quickly identify areas that need attention, and once they have finished corrections, they can review payroll before submission.

Compliance

Maintaining compliance can be challenging for staffing agencies, especially when dealing with multiple tax jurisdictions and industries. Misclassifying workers or incorrect tax withholdings can lead to severe financial penalties and lawsuits. Here are a few ways how payroll software can solve this challenge for staffing agencies.

Correct Classification and Documentation

Payroll software can help staffing agencies keep accurate records of employee classification, including part-time, full-time, and contract workers. The software can also store employment documents in a secure, cloud-based system, ensuring they are easily accessible and organized. Tools like the hourly salary calculator can further assist with correct wage calculations.

Payroll Compliance

Payroll software can help staffing agencies calculate and automate accurate payroll tax deductions for federal, state, and local taxes. It can also manage other payroll compliance issues, such as garnishments and benefit deductions. With the ability to easily calculate payroll taxes using automated systems, staffing agencies can focus on delivering high-quality services to their clients without worrying about compliance issues.

Year-End Forms

Payroll software can help streamline the year-end process by automatically populating year-end forms, ensuring timely distribution, and reducing manual entry errors.

You can also explore our detailed guide on the Staffing Agency Contract Template to simplify your contract management and get free downloadable templates!

Unique features staffing agencies’ payroll software should have

Due to the specific nature of business, staffing agencies have distinct business requirements that must be met. The Payroll software designed for staffing agencies must cater to these needs –

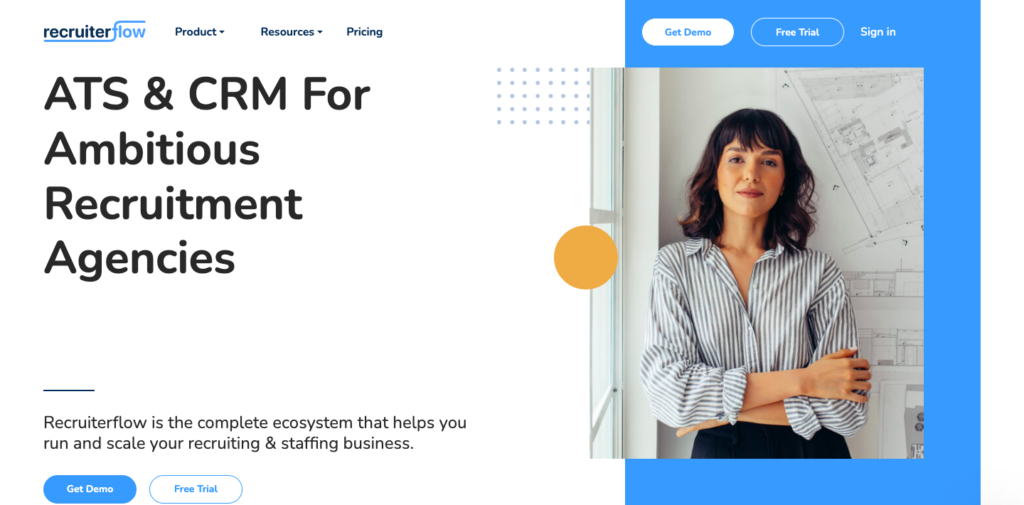

Integrates with other HR tools

Staffing agencies often face a major challenge in the form of high employee turnover rates, significantly higher than other types of businesses. The number of terminated employees can be as much as five to ten times the number of active employees.

High employee turnover rates directly impact the Payroll and HRIS platform’s required functionality. Since staffing agencies are continuously hiring, the Payroll and HRIS system must support a robust Recruitment functionality, commonly known as the Application Tracking System (ATS).

So while choosing Payroll software for your staffing agency, ensure that it has an open API to integrate with ATS software available in the market.

Modern Recruitment Software for Recruitment and Staffing Agencies

Serves as the primary system of record

The payroll software should serve as the primary “System of Record” (SOR) for employee data for staffing agencies. This means that the system must support capturing and storing all employee details from the time of hiring until termination, including comprehensive notes taken during performance reviews, feedback provided, and any issues faced at the client site during the employee’s tenure with the agency.

Provides customized reports

Staffing agencies have a unique business requirement to support the “Contract to Hire” concept, where clients can hire employees worldwide, as provided by the agency, by paying a pre-agreed rate. The rate typically decreases as the employee works more hours at the client site and may become zero after a certain number of hours.

As a result, clients frequently request staffing agencies to provide information about the hours worked by various employees. Staffing agencies need an efficient way to generate reports that display the hours worked by an employee on a particular client contract. Without these customized reports, agency staff may have to manually review different paystubs of employees to calculate the total hours worked during a certain period.

This manual process is time-consuming and prone to errors. So, choose payroll software that can generate these reports with a click.

Also Read: Recruiting Tools to kick off your hiring process

Types of Payroll software available in the market

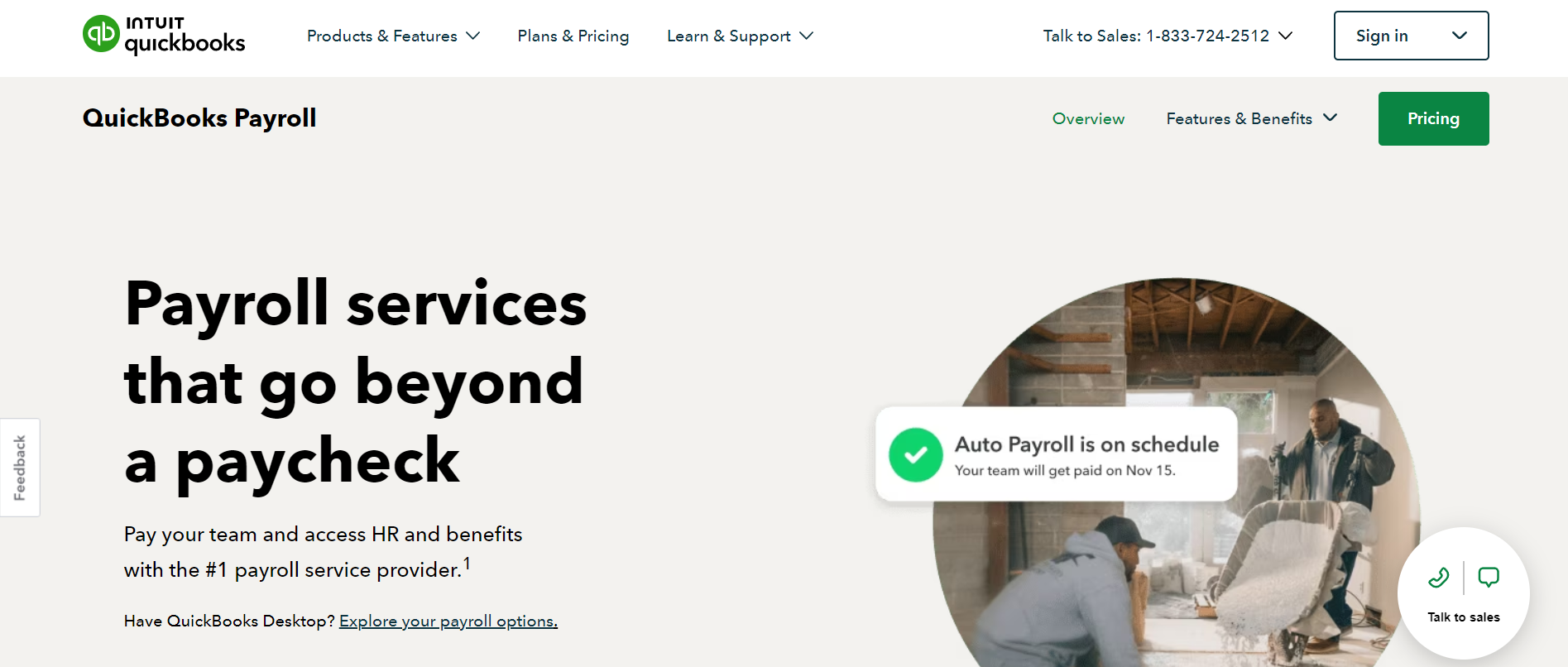

1.QuickBooks Payroll

G2 Rating: 3.8/5

Capterra Rating: 4.5/5

It is a cloud-based payroll software solution offered by Intuit, a leading accounting, and financial management software provider for small and medium-sized businesses. The software is designed to help businesses manage their payroll processes efficiently and accurately. QuickBooks Payroll offers features, including automatic tax calculations, direct deposit, and on-time payroll processing, to help businesses streamline their payroll operations.

One of the key benefits of using QuickBooks Payroll is its ease of use. The software has a simple and intuitive interface allowing users to quickly and easily navigate the various features and functions. This makes it an ideal choice for small business owners with little experience with payroll management.

Pricing Plans

- A FREE Trial plan is available for 30 days

- Core – $45 per month, plus $4 per employee.

- Premium – $75 per month, plus $8 per employee per month.

- Elite – $125 per month, plus $10 per employee per month.

2. Gusto

G2 Rating: 4.2/5

Capterra Rating: 4.6/5

Gusto is a highly user-friendly payroll software. Thanks to its affordable price tag, it offers some of the best payroll management features, making it an excellent choice for budding and growing staffing and recruitment companies. Besides payroll management, Gusto also provides solutions for employee lifecycle activities, including hiring, onboarding, benefits management, and employee exits.

Pricing Plan

- Simple — $40/month base price; $6/month per person.

- Plus — $80/month base price; $12/month per person.

- Premium — Quoted-based pricing.

- Contractor — $35/month base price; $6/month per person.

3. OnPay

G2 Rating: 4.8/5

Capterra Rating: 4.8/5

OnPay Payroll is an easy-to-use, simple, comprehensive payroll software offering scalable solutions for small and medium-sized businesses. A highly ranked payroll service, OnPay offers a wide range of benefits outside standard payroll.

This cloud-based software streamlines payroll processes and automates tax filing and payment workflows. Entering payroll information such as hours, tips, reimbursements, and bonuses seamlessly. It also incorporates other benefits (health insurance and 401(k) retirement) and compensation insurance for pay-as-you-go workers.

Pricing Plan

- The first month is free.

- Base: $40/month base price

- Plus: $6/month per person.

4. Justworks

G2 Rating: 4.6/5

Capterra Rating: 4.7/5

Justworks, the fastest-growing HR technology company, provides a seamless, simple, streamlined product built from the ground up, making it easier to start, run, and grow a business. This all-in-one platform enables employers to automate payroll, provides access to big-company benefits and HR tools, and provides 24/7 support from dedicated experts.

Pricing Plan

- No trial period

- Basic plan 2 to 4 members: $99 per employee/month

- Basic plan 5 to 24 members: $59 per employee/month

- Basic plan 25 to 99 members: $49 per employee/month

- The basic plan for more than 100 members: Contact the vendor

5. factoHR

G2 Rating: 4.7/5

Capterra Rating: 5.0/5

factoHR is a cloud-based HCM platform that makes it easier for you to smoothen HR operations. One of the most beneficial features this solution offers is the payroll management solution. You can seamlessly manage the entire payroll process, from hiring to retirement, with utmost efficiency and accuracy. Say goodbye to cumbersome manual calculations and welcome streamlined payroll management that saves you time and resources.

Experience a seamless payroll management journey with factoHR Payroll Solution. Effortlessly manage intricate tasks, ensuring precise and punctual salary processing. Navigate through employee data, deductions, reimbursements, and taxes on a single user-friendly platform. Stay fully compliant with regulations and safeguard confidential payroll information. Unleash the potential of your HR department and elevate your organization’s payroll management to unparalleled heights. Join a multitude of contented businesses entrusting factoHR for a streamlined and highly productive future.

Pricing Plan

- Free Trial

- Essential Plan

- Advance Velocity Plan

- Bolster Plan

- Performer Plan (Visit the Official Site for Actual Pricing of these Plans)

6. UKG Pro

G2 Rating: 4.2/5

Capterra Rating: 4.2/5

UKG Pro is an all-in-one software solution for business organizations. The software helps businesses in managing their HR and payroll requirements. The software is designed in such a way that the platform is user-friendly and offers a variety of features to help companies to streamline their HR processes. UKG Pro also believes in facilitating a self-service platform for employees. The candidates can track their pay stubs, request time off, and update their personal information. The software includes a robust reporting system that provides employee productivity and compensation insights.

Pricing Plan

Not available

7. Paylocity

G2 Rating: 4.4/5

Capterra Rating: 4.3/5

Paylocity is a web-based payroll solution for small to mid-sized businesses. It provides tools such as QuickPay (to process payroll in batches), a paycheck calculator, third-party direct deposit and check-creation capabilities, and Affordable Care Act compliance. Additionally, users can access tax experts who can assist with tax filings and generate quarterly and year-end reports. Paylocity also offers automated benefits administration and time and labor management solutions to manage employee attendance data.

Pricing Plan

Not available

8. Workful

G2 Rating: Not rating available

Capterra Rating: 5.0/5

Workful is an HR management solution for small businesses that offers features such as payroll processing, tax filing, employee onboarding, time tracking, and more. It lets users sync payrolls with employee timesheets, expense reports, and PTO requests.

Other features include expense tracking, document management, internal communication, multiple pay rates, custom policies, and W-2 & 1099 filing. Employees can clock in and out via a mobile app on the self-service portal. The centralized report library contains employee contact information, mileage reimbursements, paychecks, and timesheets.

With Workful, businesses can automatically calculate payroll taxes, file annual W-2 wage and tax statements, and receive payment reminders. Workful integrates with Intuit QuickBooks, allowing users to manage accounting operations for internal and external stakeholders.

Pricing Plan

- 30-day FREE trial

- Paid plan of $35/month + $6/team member/month

9. Spine Payroll

G2 Rating: 4.0/5

Capterra Rating: 3.8/5

Spine Payroll is an easy-to-use and hassle-free payroll management system. The system assists the client in managing the employees efficiently. One can also easily simplify complex HR and payroll activities. Along with this, Spine Payroll is highly flexible and customizable. The system consists of all the latest features to process things accurately.

Pricing Plan

Not available

10. Papaya Global

G2 Rating: 4.3/5

Capterra Rating: 4.6/5

Papaya is a cloud-based solution that helps businesses manage global payroll and cross-border payments. Its key features include cost breakdown analysis, data security, benefits administration, and records management. The integrated suite provides tools for hiring, onboarding, managing, and paying employees in a single end-to-end solution.

Using a third-party Global Employer of Record (EoR), the Papaya platform streamlines the hiring process across multiple countries and jurisdictions and manages classification and payments for domestic and foreign contract workers. It allows the collection of employee documentation on country-specific forms and sends alerts to employers for review when documents are needed. Managers can automate payroll processing in multiple currencies and monitor workforce spending on a centralized dashboard.

Pricing Plan

- Global Payroll and Payments: $20/month/employee

11. Rippling

G2 Rating: 4.8/5

Capterra Rating: 4.9/5

Rippling provides businesses with a centralized platform to manage HR, IT, and Finance. It consolidates various workforce systems such as payroll, expenses, benefits, and computers that are typically scattered across an organization. As a result, for the first time, businesses can automate and manage every aspect of the employee lifecycle in one system.

For instance, Rippling simplifies the onboarding process. Businesses can hire new employees from any location worldwide and configure their payroll, corporate card, computer, benefits, and third-party apps like Slack and Microsoft 365 in just 90 seconds.

Pricing Plan:

$8/month/employee

12. Zimyo

G2 Rating: 4.4/5

Capterra Rating: 4.5/5

Zimyo is a prominent Human Resource Management System (HRMS) that caters to businesses of various sizes. It offers a comprehensive Human Capital Management (HCM) platform that covers all aspects of HR management. Zimyo’s HR solutions assist organizations in automating cumbersome HR tasks, facilitating payroll processing in just three clicks, managing employee expenses and reimbursements, promoting employee engagement, monitoring and managing employee performance, streamlining recruitment and onboarding processes, managing attendance and timesheets, and providing creative and cost-effective financial solutions to employees.

Pricing Plan

- 14-day FREE trial

- Basic 60 per user per month

- Standard 120 per user per month

- Enterprise 250 per user per month

13. Homebase

G2 Rating: 4.5/5

Capterra Rating: 4.6/5

Homebase is a cloud-based platform designed for small to medium-sized businesses, including staffing agencies that manage hourly workers across multiple locations or job sites. While best known for its employee scheduling and time tracking, Homebase also offers a fully integrated payroll solution that streamlines wage calculations, tax filings, and direct deposits.

With Homebase payroll software hours tracked through the scheduling tool automatically flow into payroll, reducing manual entry and the risk of errors. It also handles tax calculations for federal, state, and local jurisdictions, and files them on your behalf. The employee self-service portal allows staff to view pay stubs, update personal information, and access W-2 or 1099 forms without involving admin teams—saving agencies time on repetitive requests.

For staffing agencies juggling seasonal workers, Homebase supports multiple pay rates and job codes, making it easier to manage diverse assignments. Its integration with popular accounting platforms further simplifies back-office operations, ensuring payroll data stays consistent across systems.

Pricing Plan

- Free plan available (scheduling, POS integration, and time tracking only)

- Essentials: From $24/month per location

- Plus: From $56/month per location

All-in-One (includes payroll): From $96/month per location

Conclusion

Payroll software can greatly benefit staffing agencies in managing their workforce efficiently, saving time, and increasing accuracy. While choosing the best payroll software for your staffing agency, it is crucial to evaluate each option carefully and choose the one that aligns with your business goals and budget.

Recruitment

Sagrika Jain