The Great Recession of 2008: Impact and Lessons for Recruiters

The world economy is sailing into a perfect storm: Europe is grappling with Russia’s invasion of Ukraine and the implications for energy imports. The United States is staring down the barrel of the highest inflation rates in 40 years last seen in the 70s. The risk of a synchronized global downturn is rising by the day.

Like every other industry, the recruitment industry will also have its share of the impact of the recession. You can read more about the impact of the upcoming recession on the recruitment industry here.

But, in this blog, we are taking you on a ride through history to make you understand more about what exactly recession is and how the great recession of 2008 impacted the recruitment and staffing industries worldwide.

What is a Global recession?

A global recession is an extended period of economic decline across the globe. Trade relations and international financial systems transmit economic shocks and the impact of recession from one country to another, resulting in more or less synchronized recessions across many national economies.

According to The International Monetary Fund (IMF), “ a decrease in per capita gross domestic product (GDP) worldwide and weakening of other macroeconomic indicators, such as trade, capital flows, and employment is a sign of global recession.”

History of global recessions

According to the IMF, there have been four global recessions since World War II. The first one began in 1975, followed by 1982, 1991, and 2009. As a result of the widespread implementation of quarantines and social distancing measures during COVID-19, the IMF declared a new recession in 2020, referred to as the Great Lockdown. This was the worst global recession since the Great Recession (2008).

Also Read: Layoff Lists And Tips To Hire Talent Affected By Layoffs

The Great Recession – 2007 to 2009

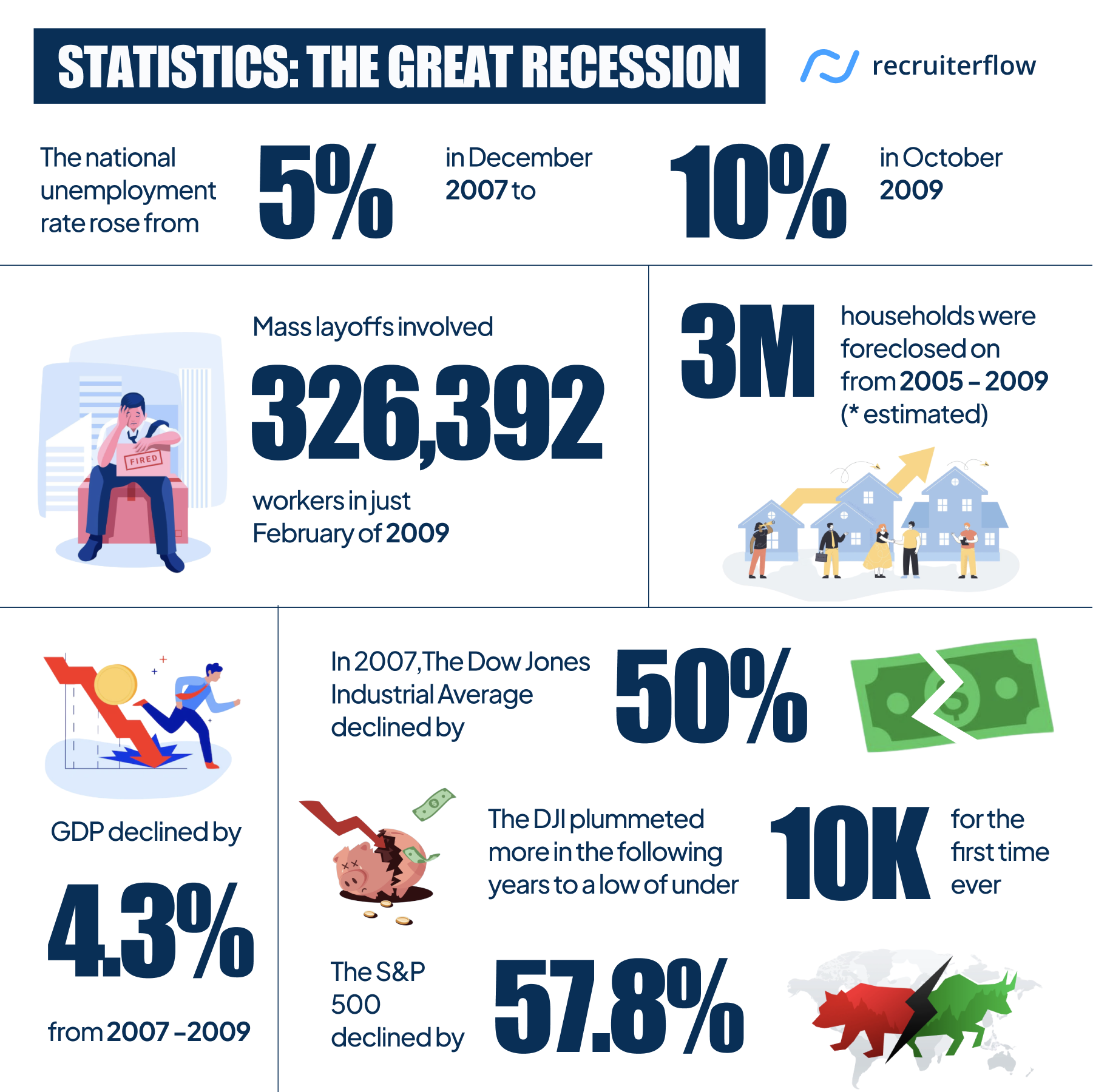

Between 2007 and 2009, a worldwide economic crisis of unprecedented severity occurred. During this recession, world trade fell by over 15% between 2008 and 2009. Global unemployment experienced a 3 percent increase between 2007 and 2010 for an astounding 30 million total jobs lost. The downturn’s magnitude, impact, and recovery differed from country to country.

Also Read: 10 tips to recession-proof your recruitment business

10 most important trends and events in the staffing world during the Great Recession of 2008

The economic crash, the number of temporary workers going down, the reduction in revenue of staffing firms by 28%, and more than a third of staffing employees losing their jobs dominated headlines for much of 2008.

While there was much to make the staffing business worry, there were still some bright spots.

Here is the Staffing Industry Report’s list of 2008’s ten most important trends and events in the staffing world.

1. Decrease in Revenue

The downturn in the economy affected staffing firms. According to Staffing Industry Analysts, the revenue of 32 of the largest public staffing operations in the U.S. firms fell by a median of 1.9% in the third quarter of 2008.

The staffing industry all over the globe saw a decline in revenue of about 12% during the Great Recession of 2008, with revenues falling from $90.3 billion in 2007 to $79.2 billion in 2009.

Also, check Strategies to Increase Staffing Agency Sales

2. Temp numbers tumbled

According to data from the U.S. Bureau of Labor Statistics, in October 2008, Temp numbers fell 11.6% annually. This was the largest decline since 2002. Temp penetration was 1.67% in October, its lowest level since 2003, according to the BLS.

3. Staffing stocks suffered

In November, the Staffing Industry Stock Index fell 3.9% after falling 26.6% in October. The index was down 37.5% through the end of November 2008.

4. Staffing firms’ grades improved

Staffing buyers gave staffing firms a grade point average of 2.98 in 2008, roughly a B, according to a survey of buyers by Staffing Industry Analysts. That’s up from a GPA of 2.73 in 2007 and a lot higher than 2004’s GPA of 1.98.

Many Staffing buyers assumed that the use of contingent workers saved their companies a median of 17% on total expenses.

5. Few sectors continued to grow

The economy in 2008 did not provide much of a reason for the staffing industry to be happy. However, there were some bright spots. The staffing segment providing temporary doctors continued to grow. According to the analysis by Staffing Industry Analysts, the Baltimore metropolitan area posted a 5.6% year-over-year increase in staffing employment levels in September 2008 and ranked as the hottest staffing market in the U.S. It also showed an improving trend in the rate of growth.

The Virginia Beach-Norfolk-Newport News area in Virginia ranked second hottest metropolitan area for staffing.

6. Bankruptcy of Ensemble Chimes Global

At one time the largest VMS, Ensemble Chimes Global, filed for bankruptcy in January 2008. The staffing industry was shocked by this event, and many firms wondered if they would get their payments.

7. New European rule

The European Parliament gave temporary workers employed through staffing firms the same pay and working conditions as traditionally employed workers.

Management and unions had the opportunity to agree to exceptions. Equal pay and conditions started on day one for most 27 member countries, but after 12 weeks in the U.K. member countries of the European Union had three years to implement the directive.

8. Big mergers and acquisitions – consolidation in the industry

On May 16, 2008, the two staffing giants Randstad Holding NV and Vedior NV merged to be one unit. In the third quarter of 2008, the last quarter reported, the combined company posted revenue of euro4.47 billion (US$6.46 billion).

Another large international deal was the merger of British staffing companies Corporate Services Group and the Carlisle Group to create Impellam Group PLC. The merger was completed on May 7, 2008, and the combined company had almost £1 billion in revenue with worldwide operations that included the U.S.

CBS Personnel Holdings Inc. also completed its purchase of Little Rock AR-based staffing firm Staffmark in 2008 after announcing the deal on Dec. 19, 2007.

9. Spinoffs and shedding operations

Several companies either spun off or sold staffing operations in 2008. IGATE Corp.’s spinoff of Mastech Holdings Inc. was completed in October. Mastech encompassed the former professional services businesses of iGate, including its information technology staffing operations and RPO worldwide subsidiary.

Westaff Inc., a Walnut Creek CA-based commercial staffing firm, sold its Australian and New Zealand operations to Humanis Blue Pty. Ltd., a division of Melbourne, Australia-based Humanis Group Ltd. Westaff also sold its United Kingdom business in March to Fortis Recruitment Group Ltd.

On September 2, 2008, Volt Information Sciences Inc., which ranked No. 7 on Staffing Industry Analysts’ list of largest staffing firms operating in the U.S., completed the sale of its non-staffing telephone directory publishing business to the Yellow Pages Group of Montreal.

How hiring changed after the Great Recession of 2008 was over

1. The Employment Gap in resumes became acceptable

Recruiters noticed that more and more resumes contained employment gaps in the post-recession world. The reason behind this was the high levels of unemployment experienced during the recession. The silver lining was recruiters had become more accepting of employment gaps. A CareerBuilder study found that 85 percent of recruiters had softened their stance on employment gaps.

However, candidates were not quite out of the woods in this scenario. For the employment gap to be “acceptable,” the candidate should have used that time to:

- Take a class/go back to school to improve their skills (according to 61 percent of respondents in the CareerBuilder study),

- Do some volunteering (60 percent);

- Or take on some temporary/contract work (79 percent).

2. Post-recession the average pay declined by 23 percent

According to Newsweek stats, most U.S. workers faced a decrease in their pay by 23% post-recession. This decline affected employers too: what they gained in terms of cost reduction, they lost in terms of productivity as workers looked to make up for meager salaries by working longer hours (or multiple jobs), which led to burnout and unproductive employees.

3. A Decline in Middle Management

According to Research, mid-wage occupations paying between $13.83 and $21.13 per hour — accounted for around 60 percent of jobs lost during the recession, but these same jobs made up just 27 percent of the jobs gained post-recovery. Interestingly, low-wage jobs accounted for 21 percent of jobs lost during the recession and 58 percent of new jobs after the recession. The employers took the recession as the opportunity to streamline organizations, reduce middle management overhead, and replace these middle managers with low-wage entry-level staff.

4. Nonprofit Jobs Occupied a Bigger Share of the Employment Market

Nonprofit jobs grew during the recession while other sectors declined. According to the U.S. Bureau of Labor Statistics, post-recession nonprofit jobs comprised about 10 percent of all non-government jobs and was the third largest sector by size compared to other industries in the U.S. This made the sector a prime opportunity for both job seekers and recruiters with a nonprofit marketing plan for hiring.

Also, check our blog on recruiting statistics.

Conclusion

It’s worth noting that the impact of the Great Recession of 2008 on the staffing industry varied by sector. Some sectors, such as healthcare and government contracting, were less affected by the economic downturn, while others, such as manufacturing and construction, saw more significant declines. Overall, however, the staffing industry as a whole saw a decline in demand and revenue during the Great Recession, with a subsequent recovery in the years since.

Recruitment

Sagrika Jain